The overview

Equity construction has been accorded to the requirements Federal Law No. 214–FZ of the Russian Federation [1] since 2004 and by town-planning legislation [2, Chapter 6].

Argentina is historical home of financing of equity construction. Equity construction in the country is known as "construcción de la equidad" (Spanish) – construction of justice. This kind of construction is an effective non-cash deposits from people for the future of housing in exchange for shares of the company, which finances real estate developers. In this perspective, equity construction made contributed to the economic recovery by attracting deposits of the population and, at the same time, protected their savings from rampant inflation.

The works of some authors are devoted to the issue of financing of equity construction basis. These works are by: Isaac Bilberry, Lepilina D.Y., Buzun E.V., Orlov V.J., Gareeva I.F., Yablochkina E.A., and others [4–7]. The articles reveals the historical and legal aspects of the scheme of interaction of the developer and landlord. However, organizational and financial aspects are not enough.

Introduction

The modern market of primary residential real estate is accompanied by a wide array of financial and legal relations. Such relations appear as in the steps of investment of designing and at stages of operation. A clear legal support for the activities of all participants of the real estate market should have transparency, feasibility and cost-effectiveness relationship. Residential real estate market is growing because of the constant citizen growth in cities. Therefore, an important issue is the search for additional financial mechanisms. One of the main types of financing mechanism is equity construction, which allows citizens to purchase much cheaper housing, compared with the secondary real estate market. The purchase is carried out at the initial stage of work, when the price per square meter is several times lower than in the already finished building. Equity participation of construction on the basis of the agreement is one of the suitable options for the house owners. However, methodological and legal support it requires deeper research

Purposes and research problems

The purpose of this article is to review the financial aspects of the equity construction of housing market of primary residential real estate.

Tasks of this studywere:

- to define the essence of equity construction and its regulatory support;

- to identify the principles of equity construction and the factors that determine the need for it;

- to evaluate the relationship between housing, housing construction in the primary market and the need for housing;

- to generate schemes of financing of equity construction and evaluate their effectiveness for the development of housing and improve housing security for population.

Consideration

Analysis of equity construction main principals allowed to identify a number of its fundamental differences:

- Equity construction is non-interest-bearing finance of the creation of residential properties;

- Equity construction should be carried out under strict control and guarantee the return of deposits to the population of the State;

- Forecast of the future construction cost of a facility is important component of the success of the market .

Orlov V.J., Gare I.F., believes that the accumulation of existing and development of new organizational and financial schemes for housing finance should be priority responsible for the development of the housing market [7]. This is necessary to attract investment resources of a wide range of stakeholders.

The relationship governing the technical aspects of the construction process are included in the first group of relations:

- the relationship of project owner and the land parcel owner;

- the relationship of project owner and contractor-designer;

- the relationship of project owner and general contractor;

- the relationship of the general contractor and subcontractors.

- the second group: the relationships that govern the guarantee of property of the construction process:

- the relationship of project owner and investor (equity holders);

- the relationship of equity holders and users of capital investment.

The advantage of equity construction includes the fact that the price of primary real estate depends on the stage of construction. In the initial stages of construction the price per square meter is lower than at a later date. Thus, the low prices attract equity holders, and the risk of a lack of funding reduce for project owner, due to the large demand. Moreover, the benefits of equity construction consists in the fact that the customer is given the opportunity to make progress payments of the apartment.

Also, the benefits are the following facts:

- Equity investment in housing construction is subject to obligatory state registration. Registration of equity construction agreement and its order are described in the Law No.122-FZ "On state registration of rights to immovable property and transactions involving such property";

- The agreement is a guarantee of the double sale of the apartment, as the state registration - it is a guarantee that an apartment had not sold and will not be sold to anyone in the future;

- The requirements of equity holders must be secured by a pledge, in case of bankruptcy of project owner.

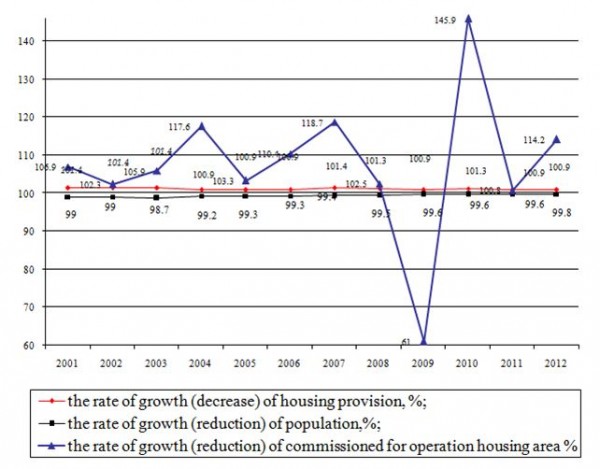

Considering the relationship between the dynamics of area of housing, population and housing per capita, housing policy data from year to year are not coordinated and the results of the new construction do not have a direct relation to the existing housing conditions and changes in the number of inhabitants (Fig. 1). Moreover, the dynamics of Ukraine shows the dependence of the housing from crisis in the economy. And vice versa, dynamics suggests that housing can serve as an indicator of socio-economic development of the state.

Figure 1. Comparison between population growth, commissioned for operation the housing area and housing in Ukraine [%].

Significant fluctuations of commissioned for operation the housing area from the dynamics of the housing provision is reflected not essential. Thus, the growth by 13.3 percentage points of housing area commissioned for operation in 2012 compared to the previous year led to an increase in housing supply only 0.1 point. Also, we should take into account the fact that the population has declined by only 0.3 percentage points. The decrease by 41.5 percentage points in 2009 compared to 2008, commissioned for operation the housing area of occurred against the background of population growth and the growth of housing only 0.1 percentage points

These imbalances reflect to shortcomings in the government's housing policy, mainly in stimulating the creation of social and affordable housing. Usage the equity construction can solve the problem of realization of ready housing.

Equity construction is relationship between parties under which one party (project owner ) is must to build an apartment building or other object of primary real estate, and after obtaining a permit for commissioning of the object, pass the appropriate object of construction to equity holders. At the same time, joint-cooperation between parties is not take place. [2]

Equity holder-natural or legal person who gives their money financed the construction of homes.

The project owner is a legal entity, individual entrepreneurs cannot be project owner.

In fact, the participants of equity construction is an investor, and the contract of participation in equity construction - an investment treaty. Such investment treaty is regulated by a separate law to protect the rights of parties.

The Federal Law No. 214-FZ "On Participation in the shared construction of apartment buildings and other real property" is protecting the participants of equity construction from unscrupulous developers [3].

Types of public relations in financing of distinguish according by legislation are:

Purchase and sale contract

This is a fundamental document for the transfer of ownership of the secondary housing market. It obliges the seller to transfer the property to the ownership of the buyer and the buyer, in turn, is obliged to accept it, by paying the appropriate amount. Moreover agreement must be made in writing.

Joint operation agreement

This is such an agreement when several persons come together without a legal entity, to achieve the desired objectives in this case - the acquisition of immovable property. Member of the agreement of joint operation is not entitled to dispose of the shares in the common property without the consent of the other parties to the agreement.

Agreement of participation in equity construction

Assessment of economic instruments is proposed by Table. 1. The table presents data on the stimulation of individual housing construction in rural areas over the years, based on the principles of equity construction.

According to economic instruments may be concluded about:

- It should be prove the connection of individual housing construction as a factor in improving the life with the priorities of the state in macroeconomic scale;

- It is advisable to provide a separate section to promote individual housing construction in terms of economic and social development of cities and regions;

- Quality control of individual housing construction in rural areas should take place on the primary financial documents and during construction;

- The state program for support of individual housing construction must be accompanied by broad public support.

Table 1. Comparative evaluation of economic instruments of stimulation individual housing.

| № | Criterion | 1988 | 1998 | 2008 | 2012 |

| 1 | The extend of credit tightening, [% of year] | 3 | 3 | 3 | 3 |

| 2 | Maximum period of loan, [years] | 50 | 20 | 20 years, young and childless families - 30 years | 20 years, young and childless families - 30 years |

| 3 | Debt rescheduling, [year] | 1-3 | - | - | - |

| 4 | Maximum loan amount

[thous. hryvnia] |

20* | 50 | 100 | 500 |

| 5 | Average monthly earnings, [hryvnia] | 199,8* | 153 | 1806 | 2965 |

| 6 | The load payments on wages to repay the loan, [%] | 17,2 | 140,3 | 15,8 | 19,3 |

| 7 | Availability of privileges | - | - | If the borrower has two or more minor children, he is exempt from paying interest on the loans | If the borrower has two or more minor children, he is exempt from paying interest on the loans |

| *Analysis presented in the national currency without inflation. | |||||

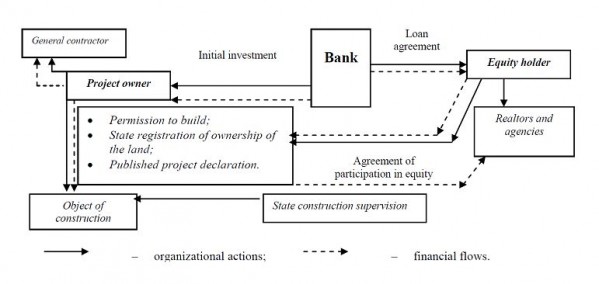

Cash flows from participatory construction shown in Fig. 2.

It should be noted that the process of construction controlled by state construction supervision. Supervision is carried out by the federal executive authority. It is also a guarantee of quality work for the equity holder.

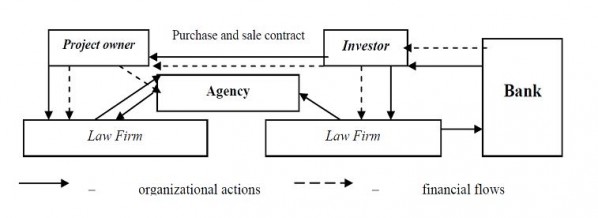

Consider the scheme of regulation of market relations in the construction abroad. Figure 3 is a diagram showing the financial flows in the equity construction, in particular for Australia [Fig.3].

Figure 2. Scheme of the financial relations of the equity construction.

Figure 3. Scheme of regulation of market relations in the construction in Australia.

In Australia, the transactions are carried out with the help of real estate agents, who are required to have a license, which entitles them to law regulation also. It should be noted that the investor does not pay for agency services, all costs paid by the developer, and it does not affect the final cost of the object.

Conclusions

Using shared construction is a promising mechanism to increase the housing supply for the population, despite the legal incidents and a large number of violations in this area. This type of construction requires the provision of state control and regulation of relations between the developer and the future owner.

Список литературы

1. Federal Law No. 214-FZ «On Participation in the shared construction of apartment buildings and other real estate and on amendments to some legislative acts of the Russian Federation» (2004).

2. "Town Planning Code of the Russian Federation" N 190-FZ (2004).

3. Metrinfo.Ru [Electronic resource] (2015) URL: http://www.metrinfo.ru/ (date request:19.10.2015).

4. Lepilin D.Yu. «Ensuring of investor Party share apartment houses», Agricultural and land rights 2010, pp. 149–151.

5. Buzun E.V., Buzun M.D. «On the history of the institute of equity in the building”, Young scientist 2015, pp. 823–826.

6. Orlov V.Ya., Gareev I.F. «Features of investment projects financing in the primary housing market», Russian journal of entrepreneurship 2010, pp. 106–111.

7. Yablochkina E.A. “Joint activities under construction residential», Science and present 2014, pp. 306–309.